NewsBank, inc.’s vision is to be the best company for its employees, customers, business partners and communities. We have been a premier information provider for over 50 years. Our comprehensive resources meet the diverse research needs of public libraries, colleges and universities, schools, military and government libraries, and professionals around the world.

NewsBank strives to provide its employees with job satisfaction, financial reward and opportunities for growth in a challenging, team-oriented work environment. Also, NewsBank employees strive to be responsible citizens in their relationships with fellow employees, customers, business partners and the communities in which they live and work.

Disclaimer: The information in this Benefits Summary is presented for illustrative purposes. While every effort was taken to accurately report your benefits, if there are any discrepancies between the information provided in this guide and information contained in carrier or employer produced Benefit Summaries and Plan Documents, please rely on the latter.

Below you will find your 2023- 2024 Benefits Guide

Medical Benefits

Welcome

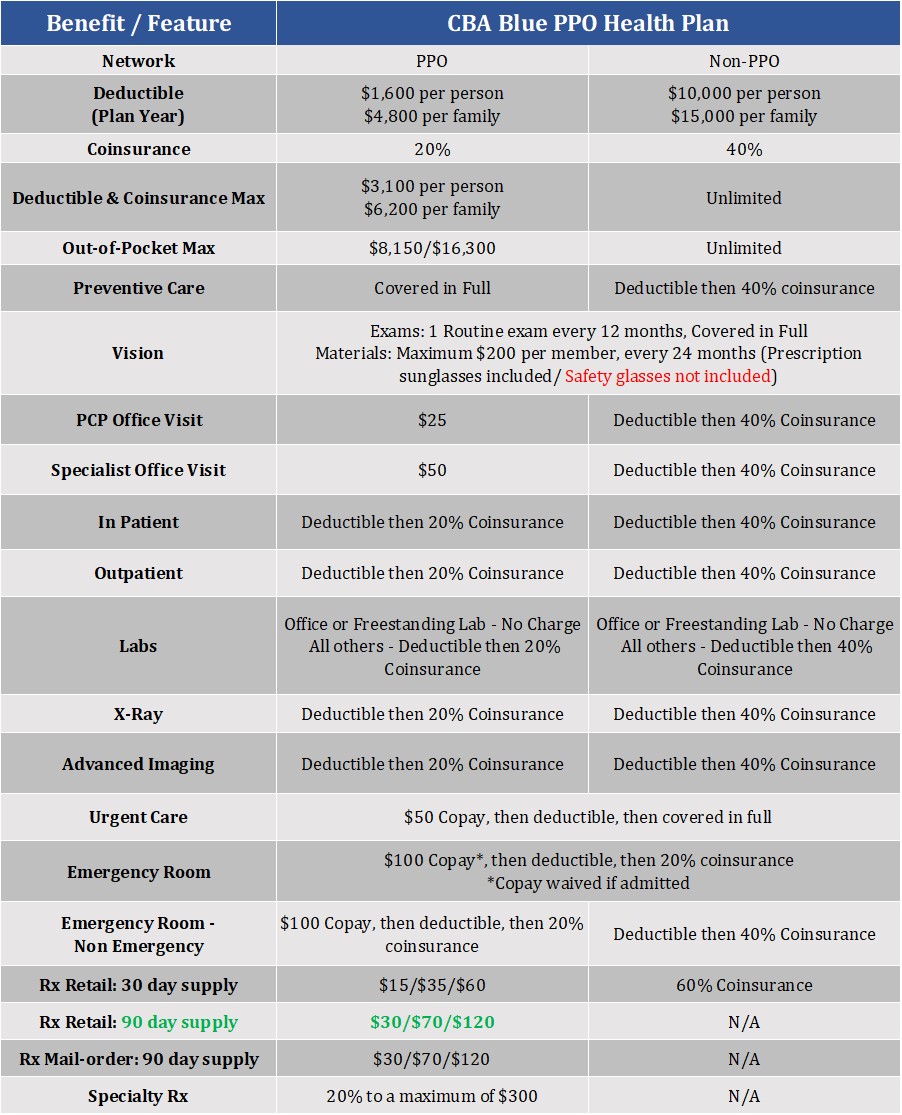

NewsBank, inc. offers one PPO Health Plan through CBA Blue.

Our objective is to offer quality coverage balanced against both the rising short- and long-term costs of healthcare.

Eligibility

All employees working 30 or more hours per week are eligible to enroll in health insurance. Eligibility for newly hired employees is first of the month following 30 days of full-time employment.

Note: A spouse who is eligible for coverage through his or her employer is ineligible for coverage through NewsBank, inc.

Benefit Information

How do I enroll?

Open Enrollment is your time to make new benefit elections or make changes to your current benefit elections. During Open Enrollment, August 2023, you will enroll through your Employee Navigator Benefits Portal.

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next Open Enrollment period, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections, outside of the normal, Open Enrollment period. Examples of Qualifying Life Events include: the birth of a child, marriage, divorce and a loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining NewsBank’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave NewsBank, inc.?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

Summary of Benefits & Coverages

There are three major components of a Health plan.

Network – NewsBank’s Health plan, administered by CBA Blue VT, uses the Blue Cross Blue Shield network.

- For a list of the participating In-network providers,

visit www.cbabluevt.com.

Cost To Use – For in-network services, you will have copays for office visits, specialist visits and emergency care. You will be responsible for meeting the deductible for most other in-network and out-of-network services, before the plan begins to pay. Once the deductible has been met, you will pay 20% coinsurance for most in-network services and 40% for out-of-network services. Coinsurance will be paid until the Out-of-Pocket Maximum (OOP) has been met. The Out-of-Pocket maximum refers to the most you will pay for covered expenses under the plan. You will experience a much higher OOP for Out-of-Network services.

Cost To Own – The amount that will be deducted from each paycheck is listed below.

NewsBanks’ prescription drugs benefits will be managed by RxBenefits using OptumRx. Effective 9/1/23 pre-authorizations and prescriptions for mail-order Rx will be done through RxBenefits. For additional information on RxBenefits and OptumRx see informational flyers.

Contributions & Rates

Rates will increase 3% if discount earned for 1/1/24 . Rates will increase higher if discount was not earned. Payroll Deductions go into effect the 2nd pay period of January 2024.

Carrier Contact Information

Plan Documents

2024 Plan Summaries will be provided soon!

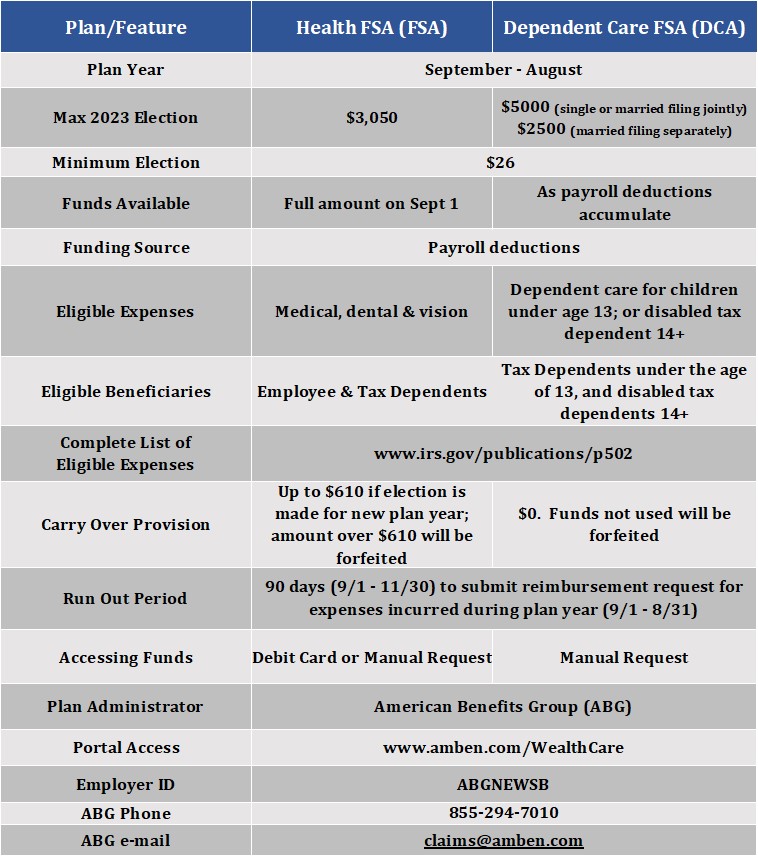

Flexible Spending Accounts (FSA) and Dependent Care Accounts (DCA)

Medical Flexible Spending Account (FSA)

What is a Medical Flexible Spending Account? A Medical FSA is a tax-advantaged employee benefit that allows eligible employees to voluntarily set aside pre-tax dollars through equal payroll deductions to be used for eligible health care expenses.

Who is eligible? The medical FSA is available to all regular full-time employees, working 30 or more hours per week, whether or not they participate in NewsBank’s Health insurance. For new hourly employees, eligibility begins following 30 days of employment.

Eligible employees may elect to contribute up to $3,050 in 2023.

Medical FSA Basics

- Medical FSAs are used to set aside money for planned or reoccurring qualified medical expenses that are not covered by insurance, such as dental care, vision care, contact lenses, co-pays, deductibles, out-of-network expenses. For a list of qualified expenses visit: https://www.irs.gov/pub/irs-pdf/p502.pdf

- Under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the definition of a qualifying medical expense now includes certain over-the-counter (OTC) medications and products. For some examples of these products, see the “Expanded FSA Expense” flyer.

- You have full access to your total election amount on the 1st day of that plan year. You do not need to wait until your FSA payroll deductions equal the amount of your qualified medical expense.

- Most transactions can be paid at the point of sale with a debit card pre-loaded with your total FSA amount for that plan year.

- You may carry $610 or less into the next plan year, if the minimum election of $26 is made. Any remaining funds exceeding $610, would be forfeited.

What is the most I can contribute?

- $3,050 for plan year

- Payroll deductions are based on 26 paychecks per year.

- For new employees enrolling after January 1, the maximum allowable amount to be set aside is prorated. Payroll deductions will be based on the remaining number payroll checks in the plan year.

Dependent Care Account (DCA)

What is a Dependent Care Flexible Spending Account?

A dependent care FSA (DCA) allows employees to set aside pre-tax dollars to pay for daycare expenses for your children under 13, or qualifying dependents. To qualify for a DCA, the IRS requires that both spouses be employed or full-time students.

Ordinarily, you may contribute up to the dependent care FSA is $5,000* (if single or married & filing jointly) or $2,500* (if married & filing separately)

Please note that the DCA is 100% employee funded and is only available to use as monetary contributions are made.

Eligible Daycare Expenses :

- Childcare or Adult Care by a licensed childcare facility, for children under 13 years of age who qualify as tax dependents.

- Childcare or Adult care for children or adults of any age who are physically or mentally unable to care for themselves and qualify as dependents.

Ineligible Daycare Expenses :

- Educational expenses including kindergarten or private school tuition fees

- Amounts paid for food, clothing, sports lessons, field trips, and entertainment

- Overnight camp expenses

- Transportation expenses

- Child Support payments

For additional information, please contact American Benefits Group at www.amben.com.

Employer ID: ABGNEWSB

Visit https://www.irs.gov/forms-pubs/about-publication-503 for a comprehensive list of eligible expenses, federal laws and regulations.

How do I enroll in the FSA or DCA?

Whether you are enrolling for the first time, or continuing to participate in the new plan year, you would need to complete your enrollment through your Employee Navigator Benefits Portal at www.employeenavigator.com.

Once you have made an election, unless you experience a qualifying event, you are unable to make changes until the next open enrollment period.

Carrier Contact Information

American Benefits Group: Flexible Spending Accounts (FSA & DCA)

Customer Service: 855-294-7010

Website: www.amben.com

Forms and Plan Documents

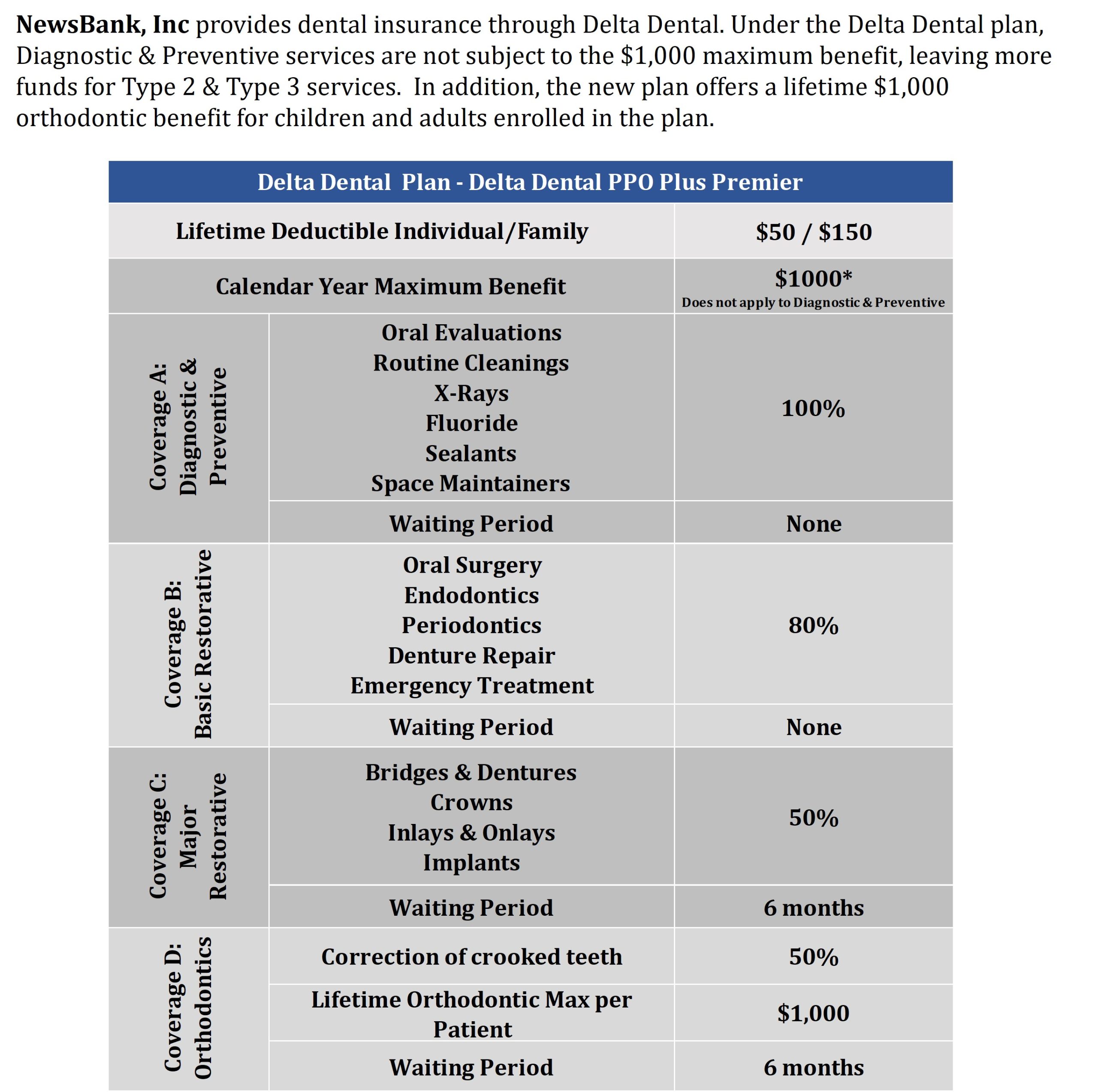

Dental Benefits

Eligiblity

All employees who work a minimum of 30 hours per week are eligible following 30 days of employment.

Summary of Benefits and Coverages

Plan Overview

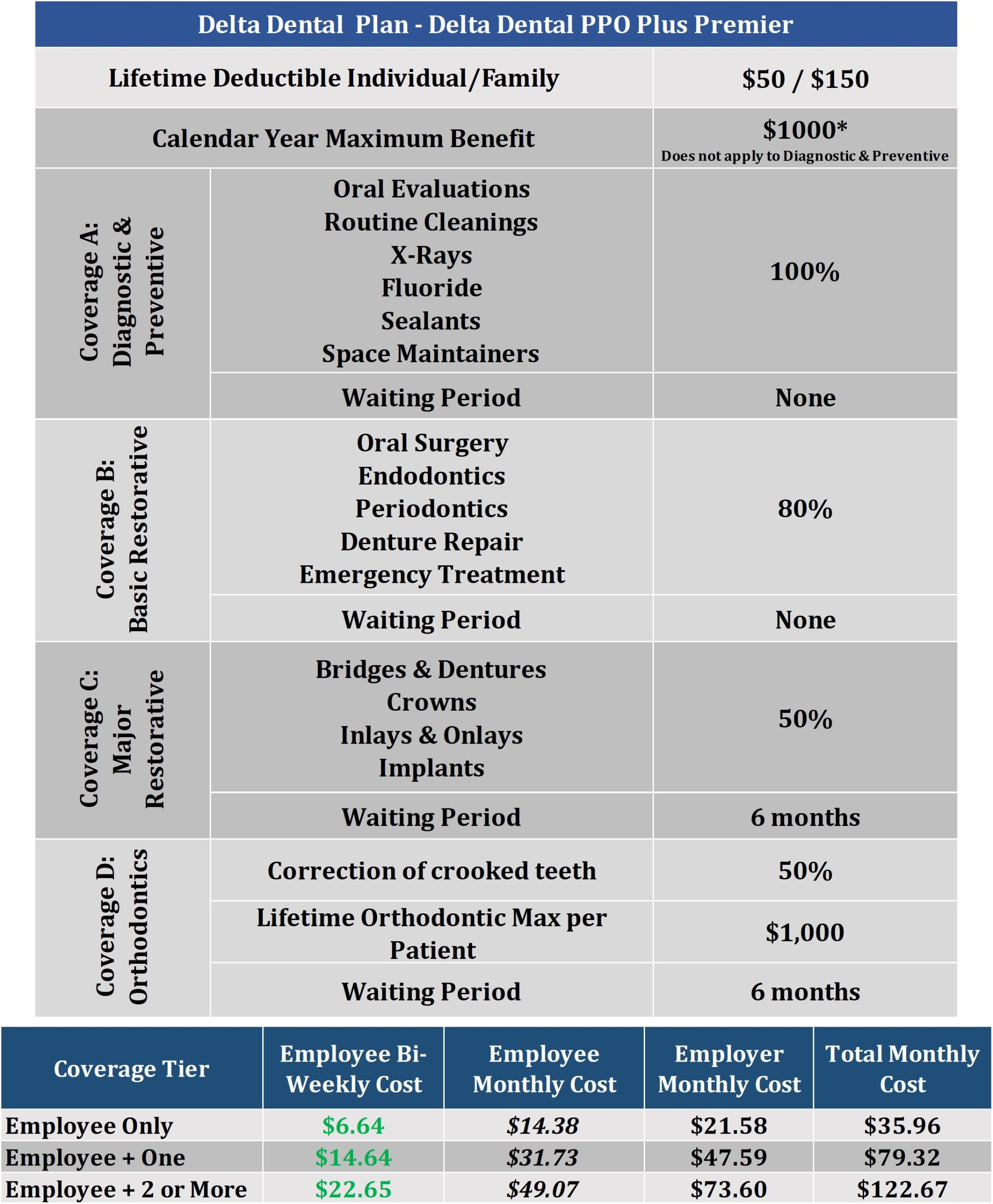

NewsBank, Inc provides dental insurance through Delta Dental. Under the Delta Dental plan, Diagnostic & Preventive services are not subject to the $1,000 maximum benefit, leaving more funds for Type 2 & Type 3 services. In addition, the new plan offers a lifetime $1,000 orthodontic benefit for children and adults enrolled in the plan.

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by NewsBank, inc.

When considering whether purchasing dental insurance makes sense for you and your family, there are three things you should consider:

Network – Delta Dental has an extensive network. To search for in-network providers, visit https://www.deltadentalins.com. If you visit a non-participating (Out-of-Network) dentist, you are required to pay the difference between the plan payment and the provider’s actual fee for covered services.

Cost to Use – There is no deductible for Preventive Services (Type 1). For Basic services (Type 2) and Major services (Type 3) you will pay a per benefit period deductible of $50 per person or maximum deductible of $150 for a family.

The annual maximum for the plan is $1,000 per member.

After meeting the deductible, you will be responsible for 20% of the cost of in-network Type 2 services, 50% of Type 3 services, and 100% of all services once you’ve reached your annual max of $1,000.

Cost to Own – What will your per paycheck deduction be? The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

2023 Carrier Contact Information

![]()

Delta Dental: Dental Insurance

Customer Service: 800-521-2651

Website: www.deltadentalins.com

Group Life Insurance

Eligibility

Employees who work 30+ hours per week are eligible following 30 days of employment.

Summary of Group Basic Life and AD&D Benefits and Coverages

Group Basic Life

COVERAGE:

Benefits are 1x salary to a maximum of $50,000.

AD&D: Amount is % of Life Benefit based on loss

Conversion: You may convert your group policy to an individual whole life policy if your employment ends.

Age Reduction: At age 65 Employee Supplemental and Dependent Life reduces to 65% of the original coverage amount.

Voluntary Supplemental Life

COVERAGE:

Employee: Benefits available in increments of $10,000, up to 5x salary to a maximum of $300,000.

Spouse: Benefits available in increments of $5,000, not to exceed 50% of the employee amount, up to a maximum of $100,000.

Child: Less than 26 – $2,000, up to $10,000. Rate is $.073 per $1,000, per month.

GUARANTEE ISSUE: Only applies during initial enrollment period.

Employee: $150,000

Spouse: $25,000

Child: $10,000

Conversion: You may convert your group policy for you and your spouse to individual whole life policies if your employment ends.

Age Reduction: At age 65 Employee Supplemental and Dependent Life reduces to 65% of the original coverage amount.

Coverage ends at retirement if occurring prior to age reductions.

AD&D: Amount is equal to life coverage and not available on dependent life plans. Rate is $.02 per $1,000.

Carrier Contact Information

Symetra: Life and AD&D

Customer Service: 800-796-3872

Website: www.symetra.com

Forms & Plan Documents

STD Coverage

Eligibility

Employees who work 30+ hours per week are eligible following 30 days of employment.

Voluntary Short-Term Disability

Elimination Period: Benefits begin on the 1st day after an Accident, or 8th day after an illness

Max Benefit Duration: 13 weeks for Exempt employees and 26 weeks for Non-exempt employees.

Maximum Benefit: 66 2/3% of salary or $500 for Exempt employees and $250 for non-exempt employees.

Carrier Contact Information

Symetra: Short-Term Disability

Customer Service: 800-796-3872

Website: www.symetra.com

Forms & Plan Documents

Long-Term Disability

Eligibility

All employees who work 30 or more hours per week are eligible following 30 days of employment.

Long-Term Disability

Elimination Period: 90 Days after the onset of a disability or illness.

Max Benefit Duration: Varies depending on age at benefit start.

Maximum Benefit: 60% of salary up to $12,000.

Value-Added Programs

Employee Assistance Program (EAP) with Will Preparation

Finds the resources employees need to help with a variety of issues such as finding child or elder care, managing a serious illness or dealing with work/life issues.

1-888-327-9573 or www.guidanceresources.com

Organization ID: SYMETRA

Health Care Navigation

Encourages employees on a covered disability leave to become educated, engagedconsumers in their health care.

1-866-263-4365

Travel Assistance

Provides support when employees are traveling 100 miles or more away from home.

1-877-823-5807 from North America or 240-330-1422 from anywhere

Identity Theft Protection Program

Helps protect employees from ID theft while providing support in the event their identity is stolen.

1-877-823-5807 from North America or 240-330-1422 from anywhere

Beneficiary Companion

Offers a helping hand for families after a loss.

1-877-823-5807

Carrier Contact Information

Symetra: Long-Term Disability

Customer Service: 800-796-3872

Website: www.symetra.com

Forms & Plan Documents

Employee Assistance Program (EAP)

Eligibility

The EAP program is free to all employees and their household members

EAP Details

NewsBank’s EAP Program is administered by Magellan Health. The Employee Assistance Program (EAP) through Magellan Healthcare provides professional services to address a variety of personal, family, life, and work-related issues. EAP benefits are 100% confidential.

Website: https://member.magellanhealthcare.com/

- Organization: NewsBank, Southwestern Imaging Services, or SIS

Phone: 1-800-523-5668

Some of the key features of the program are:

- Coaching

- Counseling

- Digital and Emotional Wellness Tools

- Legal Assistance, Financial Coaching & Identity Theft Resolution

- Work-Life Balance Services

- Wellness Resources

People often need to take advantage of available resources, resulting in continuing struggles. Your program is here to help you along the journey of life. No situation is too big or too small. When you and your household members need assistance, reach out anytime, and we will help get you on the right path to meet your needs.

Employee Assistance Program: Magellan Health

Member Services: 800-523-5668

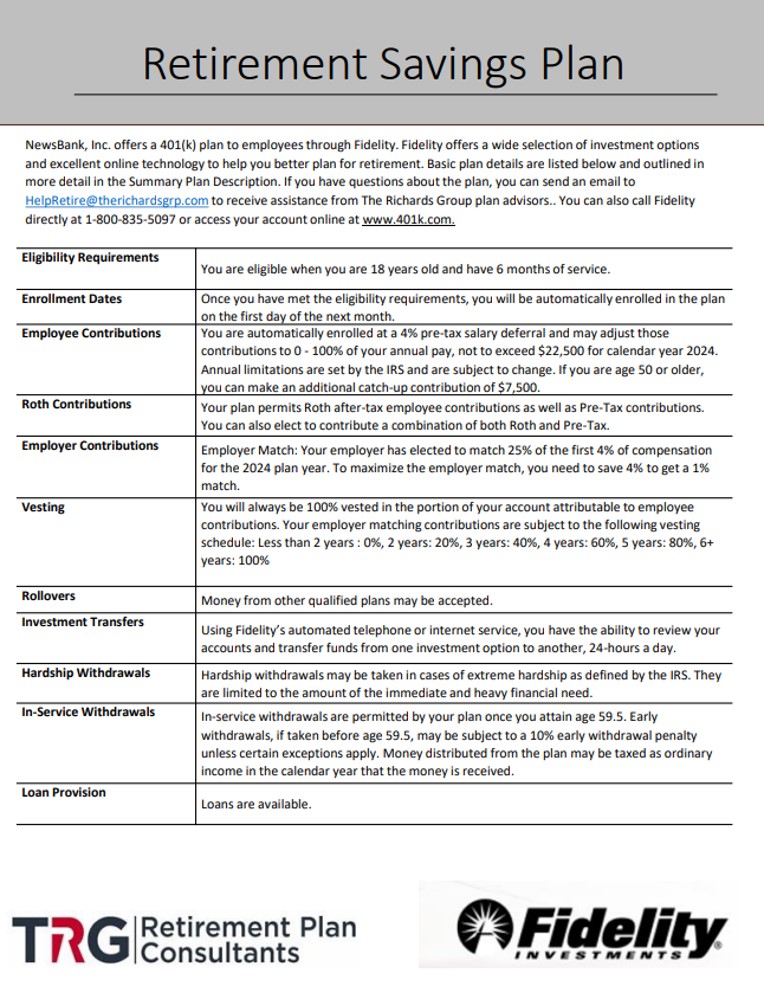

401(k) Retirement Plan

Eligibility

401(k) Plan Details

NewsBank’s retirement plan is administered by Fidelity Investments. Associates are eligible after 6 months of service if they are at least 18 years of age. The company may match 25% of an employee’s deferral contributions up to a maximum of 4% of eligible compensation.

The online portal is: http://www.401k.com/

Save for retirement through NewsBank Retirement Savings Plan easily, regularly, and automatically. With all the responsibilities and financial priorities you might be juggling – mortgage payments, parenthood, saving or paying for college, caring for parents, and more.

It can be easy to overlook the need to save for retirement. But it’s important to consider setting aside money for retirement as early and regularly as you can, because the quality of your retirement years could very well depend on how much you have been able to save. As you consider enrolling in NewsBank Retirement Savings Plan and selecting investment options for your account, please review this Enrollment Guide. It contains valuable information that may help you better understand the basics of investing, as well as help you make the most of your company’s retirement savings plan.

Retirement 401(k): Fidelity Investments

Member Services: 800-890-4015

Website: www.fidelity.com

SmartConnect- Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/therichardsgroup

Additional Information